OECD analysis finds new evidence for balancing direct and indirect support for business R&D

Mark MannSeptember 23, 2020

A recent OECD report offers "new evidence on the impact of R&D tax incentives and direct funding of business R&D." Drawing from the first phase of the OECD microBeRD project (2016-19), the report examines how well such policies boost investment in R&D, compared to when no support is provided.

Despite the vital role of business R&D in driving economic growth, firms often decline to make this type of investment over concerns about cost or the possibility of knowledge spillovers. Further, the benefits of business R&D have been shown to accrue more to society at large than to the firms themselves. To compensate for this market failure, governments are motivated to incentivize R&D performance, but they have traditionally been divided over how much to provide through direct funding like grants and procurement versus indirect funding like tax incentives related to R&D incomes or expenditures.

Using a method for measuring "R&D input additionality" based on micro-aggregated data for 20 OECD countries as well as firm-level data, the new analysis reveals that one extra unit of R&D tax support translates into 1.4 extra units of R&D. Direct funding obtains a similar outcome, which "hints at the potential complementarity of direct and indirect support measures," the report states.

Despite leading to similar overall increases in "extra units of R&D," direct and indirect funding tend to promote different types of outcomes. Direct support measures are more conducive for bolstering research, while tax support generally results in more experimental development. For its part, lowering corporate income tax does improve R&D investment, but significantly less effectively than more targeted R&D supports.

John Lester, an executive fellow at the University of Calgary's School of Public Policy, notes that the OECD includes procurement in its estimate of direct support, which he suggests "taints the analysis of the relative effectiveness of direct and indirect support." Focussing on grants and contributions would provide more interesting results, he said in an email to Research Money.

Rising support for indirect funding

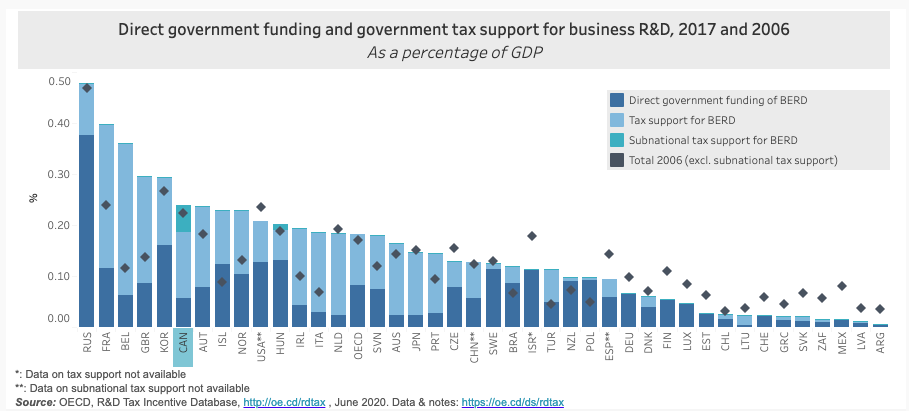

The OECD report states the last two decades have seen growing support for R&D tax incentives among policymakers. Indirect funding accounted for 50 percent of government support for business R&D in 2017, compared to 30 percent in 2000.

For example, Quebec’s 2020 budget demonstrated a preference for indirect support, with $1 billion in new and updated incentives to support private sector innovation: the incentive deduction for the commercialization of innovations (IDCI) that reduced taxes on revenue attributable to IP commercialized in Quebec to just 2 percent; the synergy capital tax credit (SCTC) for high-growth SMBs; and the investment and innovation tax credit (C3i) for investments in modernizing technologies and equipment.

Canada is well known for generously subsidizing innovation and has long been an outlier among OECD countries for strongly emphasizing indirect over direct support, though recent years have seen a slight shift back toward grants and contributions. For example, the National Research Council's Industrial Research Assistance Program (IRAP) nearly doubled since 2012-13, from $170 million to $307 million. Even so, the SR&ED incentive is still forecasted to value $2.8 billion in 2020. The new OECD report highlights the fact that many other countries have joined Canada in emphasizing tax incentives.

Direct government funding and government tax support for business R&D, 2017 and 2006

Direct government funding and government tax support for business R&D, 2017 and 2006Some experts question the benefits of tax incentives, however, despite their growing popularity as a funding lever. "I'm of the school that we were misguided in expecting that incentives delivered to the tax system would be the best approach to supporting innovation amongst Canadian firms," said Margaret Dalziel, an associate professor at the University of Waterloo's Conrad School of Entrepreneurship and Business. "If a firm doesn't have the capabilities to do the right things, it doesn't matter how much money you dump on it, it's not going to be competitive." She pointed to North (formerly Thalmic Labs) as an example of a company that received a lot of government support for R&D but did not survive.

The difference between big and small

The OECD report finds that tax incentives have greater impact on small firms compared to medium and large firms, a finding that is consistent with other Canadian studies, says Dalziel. "This is a reflection of the fact that smaller firms perform, on average, less R&D than larger firms, rather than of economic size as such," the report states.

For his part, Lester argues that Canada provides excessive subsidies for small firms and an inefficiently low subsidy rate for R&D performed by large firms. For example, knowledge spillovers from small firms are much smaller than from large firms, and so the subsidy rate for small firms should be lower, not higher, than for large firms, he says.

Lester is currently preparing a formal benefit-cost analysis of SR&ED tax incentives, for which the preliminary results suggest an optimal subsidy rate of 15-20% for small firms compared to 25-30% for large firms. The SR&D small firm rate of 35% is 15-20 percentage points too high, he says. Lester points out that several thousand firms receive IRAP grants on top of the SR&ED credit, which could translate to an overall subsidy rate of 60%. "When is too much?" he asks. "Anything approaching 60% is crazy."

To help small firms with the cash constraints that prevent them from engaging in R&D, governments should take a more targeted approach and look for ways to help them acquire financing, for example, rather than rely so heavily on a blanket tax incentive, Lester suggests.

R$

Events For Leaders in

Science, Tech, Innovation, and Policy

Discuss and learn from those in the know at our virtual and in-person events.

See Upcoming Events

You have 0 free articles remaining.

Don't miss out - start your free trial today.

Start your FREE trial Already a member? Log in

By using this website, you agree to our use of cookies. We use cookies to provide you with a great experience and to help our website run effectively in accordance with our Privacy Policy and Terms of Service.